AI-Powered Financial Services

Intelligent financial planning and optimization solutions tailored for West Virginia's small businesses

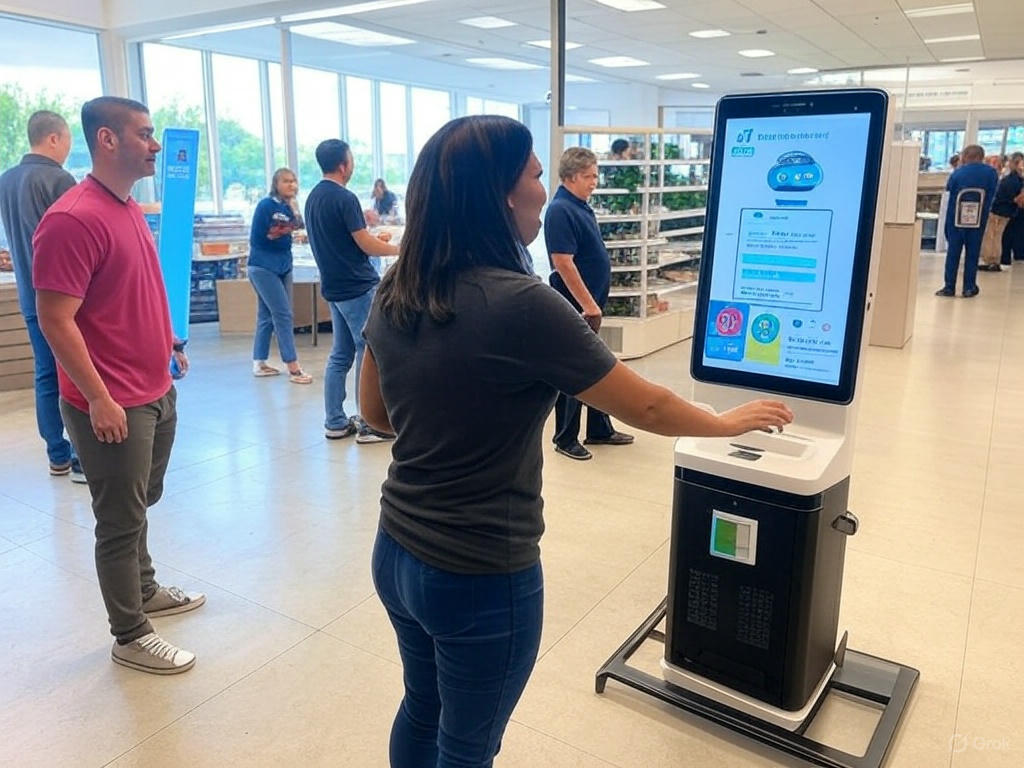

Transform Your Business Finances with AI

West Virginia's small businesses face unique financial challenges - from seasonal customer fluctuations to limited planning resources. Our AI-powered financial services bridge the gap, giving you the sophisticated financial tools and insights previously available only to large corporations.

Whether you run a Main Street retail shop, a family restaurant, or a pop-up stand at local festivals, our intelligent financial tools help you make smarter decisions, optimize cash flow, and maximize profitability without requiring financial expertise.

Our Financial AI Services

Smart Budgeting

AI-powered tools that analyze spending patterns and suggest optimized budgets based on your business data.

Predictive Forecasting

Advanced forecasting systems that predict revenue trends, helping you prepare for peaks and valleys.

Investment Analysis

Data-driven insights to evaluate ROI on business investments and guide strategic decision-making.

Cash Flow Management

Proactive cash flow monitoring and optimization to prevent shortfalls and maximize working capital.

How AI Transforms Financial Planning

Intelligent Budgeting

Our AI systems automatically categorize expenses, identify spending patterns, and generate optimized budgets based on your historical data. The AI can detect seasonal fluctuations, flag unusual expenses, and suggest areas for cost reduction. Instead of guesswork, you'll have data-driven budgets that accurately reflect your business needs.

Predict your business's financial future with AI forecasting that considers historical data, seasonal trends, and even local West Virginia events. Our predictive models help you anticipate cash flow challenges months in advance, project sales for upcoming quarters, and run "what-if" scenarios to test different business strategies.

Predictive Forecasting

Investment Strategy

Make smarter investment decisions with AI-powered ROI analysis. Whether you're considering new equipment, a location expansion, or a marketing campaign, our AI tools analyze potential returns based on your business data and market trends. Evaluate multiple options simultaneously and gain confidence in your strategic choices.

Maintain healthy cash flow with AI systems that monitor receivables, payables, and bank balances in real-time. Our tools provide early warnings for potential cash shortfalls, optimize payment timing, identify late-paying customers, and ensure you always have enough working capital to operate smoothly and cover unexpected expenses.

Cash Flow Optimization

Our Implementation Process

Assessment

We evaluate your current financial processes and identify opportunities for AI enhancement

Configuration

We customize our AI tools to match your business needs and integrate with your existing systems

Training

We help you and your team learn to use the new AI tools effectively

Ongoing Support

We provide continuous assistance and refinement to maximize your financial benefits

Success Stories

Retail Store in Beckley

This small Beckley retail store used our AI budgeting tools to analyze seasonal spending patterns. The AI identified that they were overstocking certain items in winter months, tying up valuable cash. By optimizing their inventory based on AI recommendations, they reduced excess stock by 25% and improved their cash position by $15,000.

Restaurant in Huntington

This family-owned restaurant in Huntington implemented our AI cash flow management system after experiencing several unexpected cash shortfalls. The AI forecasting tool predicted a major cash crunch three months in advance, allowing them to secure financing early. Now they maintain consistent cash reserves through automated prediction.

Integration Partners

Our financial AI tools seamlessly integrate with popular accounting and business management platforms, allowing you to enhance your existing systems.

Frequently Asked Questions

Do I need accounting expertise to use these tools?

No. Our AI financial tools are designed to be user-friendly and accessible for business owners without financial expertise. The systems present insights and recommendations in plain language, and our team provides training and support throughout implementation.

Is my financial data secure?

Absolutely. We implement bank-level security protocols to protect your financial information. All data is encrypted both in transit and at rest, and we adhere to strict privacy policies that prevent unauthorized access to your business information.

How quickly can I see results?

Most businesses see initial insights within the first week of implementation. Cash flow improvements typically emerge within 30 days, while more substantial benefits from budgeting and forecasting optimizations usually become apparent within 2-3 months as the AI learns from your business patterns.

Can these services work for very small businesses?

Yes. We've designed our financial AI services to scale from solo entrepreneurs to medium-sized enterprises. Our solutions are particularly valuable for smaller businesses that don't have dedicated financial staff, as they provide professional-level financial insights without requiring a financial department.

Learn More About AI Financial Planning

AI-Driven Financial Planning for West Virginia's Small Enterprises

How small businesses across West Virginia can leverage AI tools for better budgeting, forecasting, investment decisions, and cash flow management.

Read Article →

Small Business AI Solutions

Discover our complete suite of AI solutions designed specifically for West Virginia's small businesses.

Explore Services →

Ready to Transform Your Business Finances?

Schedule a free consultation to discover how our AI financial services can help your West Virginia business thrive.

Get Started